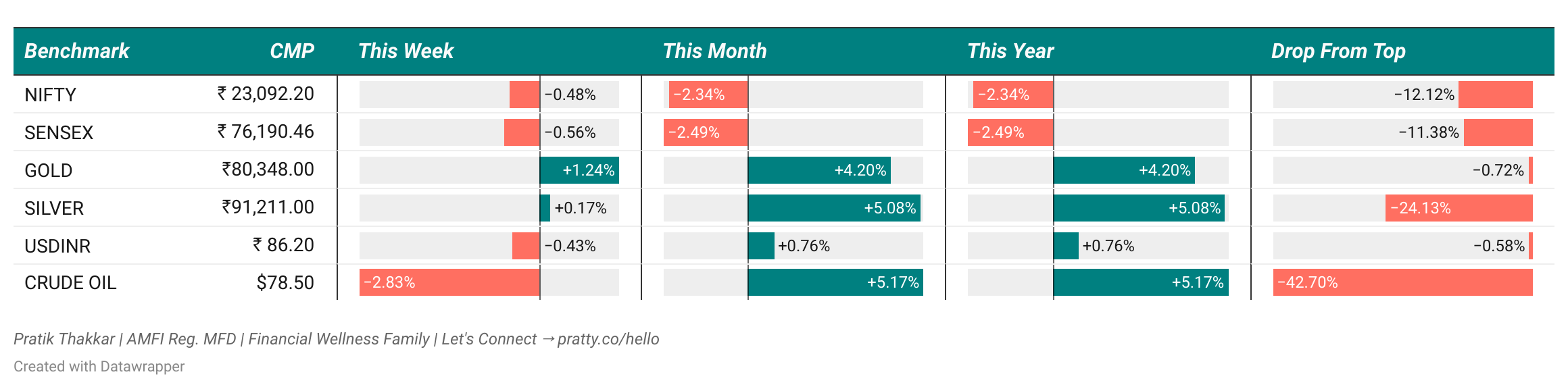

📊Weekly Market Snapshot

Markets were volatile this week, with the Nifty swinging between gains and losses. Gold has posted a spectacular comeback this month and is just shy of the previous all-time high.

While earnings from key players drove occasional recoveries, broader indices often underperformed.

Weak global cues, FII selling, and growth concerns kept sentiment cautious.

Sectoral performance was mixed, with PSU banks and consumer durables leading gains on select days, while realty and media lagged.

As the Union Budget approaches, markets remain on edge, with investors closely watching for stabilization signals.

💡Weekly Family Financial Wisdom

More Funds, More Mess: Why Too Many Mutual Funds Hurt Your Wealth

Owning too many mutual funds isn’t diversification; it’s a shortcut to diluted returns and financial stress.

1. Diversification Isn’t Duplication

Owning 15 funds with similar investments doesn’t reduce your risk—it amplifies your confusion.

For example, if most of your funds focus on large-cap stocks, you’re repeating the same investment across multiple funds. True diversification means spreading investments across different asset classes, like equity, debt, or international funds, not piling up funds that invest in the same stocks.

Fewer funds, chosen thoughtfully, protects your portfolio better.

2. Too Many Funds Dilute Returns

When your money is spread thin across multiple funds, growth becomes sluggish.

For instance, instead of concentrating ₹5 lakhs in 3 strong funds, dividing it across 10 funds often results in smaller, less impactful gains. It’s like trying to grow a garden with too little water for each plant.

Focused investments grow wealth faster.

3. Simplicity Wins Every Time

Managing fewer funds is easier and saves time.

A portfolio with 3–4 well-picked funds is simpler to track, review, and adjust during financial changes. Think of it as managing a small kitchen versus a cluttered pantry—you’ll spot what’s missing or needs fixing quicker.

Simple portfolios are stress-free.

4. Every Fund Must Have a Purpose

Each mutual fund in your portfolio should serve a unique goal.

If a fund doesn’t help you meet specific objectives, like saving for your child’s education or retirement, why own it? Avoid adding funds impulsively; ensure each has a clear role in your financial journey.

Purposeful funds add real value.

5. Resist the FOMO

Exciting new funds will always tempt you, but not all are necessary for your goals.

For example, a trendy small-cap fund may look appealing, but if your portfolio already has enough exposure to small-caps, adding more adds no real benefit. Stay focused on what matters to your goals.

Avoid chasing trends over logic.

Owning fewer mutual funds keeps your portfolio manageable, purposeful, and ready to deliver meaningful growth. Choose wisely.

🛠️ Question of the Week

What’s your biggest challenge when managing debt?

Keeping track of due dates

Finding extra money to pay off debt faster

Understanding how interest works

Staying disciplined with repayment plans

Avoiding new debt while paying off old debt

(This form is completely anonymous. You will be able to see the responses summary of others’ once you submit.)

⚠️Disclaimer

This newsletter is for educational purposes only and should not be construed as investment advice. Mutual fund investments are subject to market risks. Please read all scheme-related documents carefully before investing.

Did you find this newsletter helpful?

Share it with another family who might benefit: