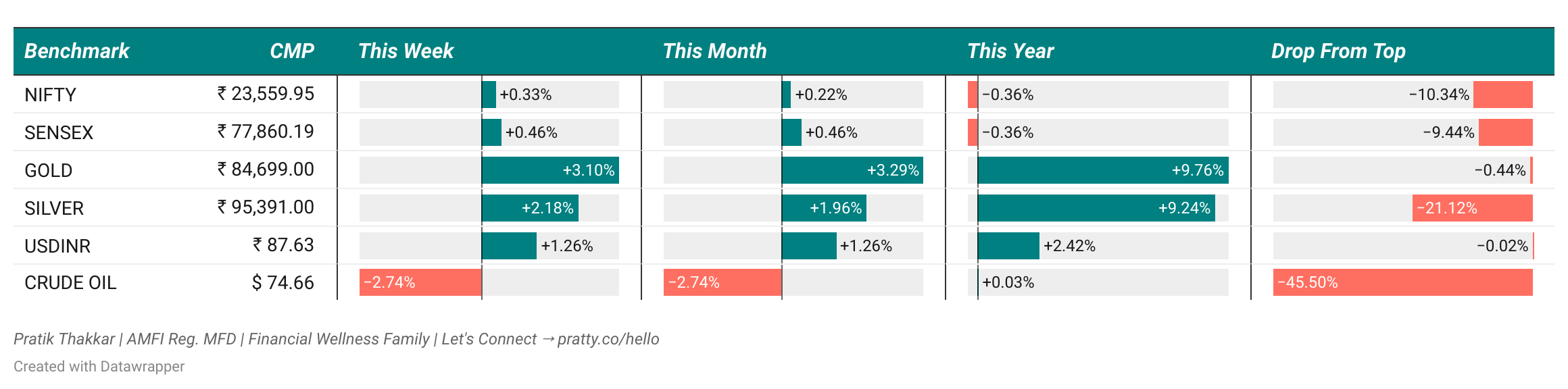

📊Weekly Market Snapshot

Markets remained volatile this week, with Nifty swinging between gains and losses.

Weak global cues and U.S. tariff concerns pressured markets early in the week, but RBI rate cut provided some relief.

Sectoral performance was mixed, with energy and banking stocks leading gains while FMCG and realty lagged.

Broader markets struggled, showing weak breadth.

As earnings season wraps up, global cues and domestic economic developments will drive market sentiment in the coming week.

💡Weekly Family Financial Wisdom

How Indian Families Can Save More Tax With an HUF

A Hindu Undivided Family (HUF) is a separate taxpayer, allowing families to legally reduce taxes.

1. A Separate Taxpayer for the Family

A Hindu Undivided Family is treated as a separate taxpayer under Indian tax laws.

A family can form an HUF and file a separate income tax return. This means income from ancestral property, rent, or a family business can be taxed under the HUF instead of adding to an individual’s income.

For example, if a family earns ₹5 lakh from a rental property, the HUF pays tax on it separately. This helps avoid pushing an individual into a higher tax bracket.

HUF status allows families to divide income and reduce tax liability.

2. Extra Tax Deductions Like an Individual

An HUF gets the same tax benefits as an individual taxpayer.

HUFs can claim standard deductions on house property income, interest on savings accounts, and eligible expenses. Investments in PPF, life insurance, and ELSS under Section 80C help reduce taxable income.

For instance, if an HUF invests ₹1.5 lakh in PPF, the entire amount is deductible under Section 80C, reducing taxable income.

Using HUF tax benefits means more savings for the family.

3. Tax-Free Income Opportunities

Some types of income earned by an HUF are fully exempt from tax.

Income from agricultural land owned by the HUF is not taxed. If the HUF sells crops worth ₹3 lakh, no tax applies.

This tax-free income increases family wealth without extra burden.

4. More Tax Savings on Investments

Investments made by an HUF are separate from individual members' investments.

If an HUF invests in fixed deposits or mutual funds, the interest or gains are taxed under the HUF, not a family member’s name. This prevents individuals from exceeding tax-free limits.

A family can maximize tax benefits by managing investments through an HUF.

Setting up an HUF is a smart way for families to save taxes legally. If eligible, forming an HUF can help secure more savings for the future.

🛠️ Question of the Week

What’s your biggest emotional challenge when investing?

Fear of losing money

Selling too early or too late

Following the crowd instead of my plan

Staying patient during market downturns

(This form is completely anonymous. You will be able to see the responses summary of others’ once you submit.)

⚠️Disclaimer

This newsletter is for educational purposes only and should not be construed as investment advice. Mutual fund investments are subject to market risks. Please read all scheme-related documents carefully before investing.

Did you find this newsletter helpful?

Share it with another family who might benefit: