Systemize Your Option Trading in 3 Easy Steps

Discover the secrets to systemize your option trading and achieve stress-free success.

Aspiring side hustlers in options trading are facing the challenge of inconsistency.

The terrible consequence?

Costly mistakes leading to losses.

Read on to know 3 simple steps to systemize your side hustle.

If you follow these steps, you will be able to:

Increase the profitability and consistency of your trades.

Save time and energy by simplifying the trading process.

Be calm and relaxed by having a stable and consistent system.

But not everyone can do this.

Many people who try to trade options lose money and confidence.

They make mistakes that cost them a lot of money.

They do this because they keep juggling inconsistently between their full-time job and option trading.

The main reason why people do this is because they don’t have trading rules.

Without trading rules, they:

Trade with their feelings, not with their brains

Trade without a plan, a goal, or a limit

Trade too much, too big, or too risky

They waste time, energy, and money on random and wrong trading methods.

They get stressed and scared by the market.

But you can avoid these problems by making your option trading easy in 3 steps.

These steps will help you make a system for your option trading.

Let me show you how.

Step 1: Make Trading Rules

The first step to make your option trading easy is to make trading rules.

Trading rules are the things that tell you what to do and what not to do when you trade.

To make trading rules, you need to answer four questions:

What do you trade? This is the thing you trade, like stock options or index options. You should pick something that fits your style, money, and risk. For example, if you are new and have a small account, you may want to trade options on indices that are not too wild and easy to trade.

When do you trade? This is the time you trade, like daily, weekly, or monthly. You should pick a time that matches your goals, time, and personality. For example, if you are busy and have a long-term view, you may want to trade options on a monthly basis.

How do you trade? This is the way you trade, like up, down, or sideways. You should pick a way that uses your strength, like trend, range, or volatility. For example, if you are good at analyzing the market trend, you may want to trade directional trends, like long calls or puts, or vertical spreads.

Why do you trade? This is the reason you trade, like charts, news, or feelings. You should pick a reason that supports your trading, like entry, exit, or adjustment. For example, if you use charts, you may want to trade options based on price patterns, indicators, or signals.

By answering these four questions, you will be able to make trading rules and make your option trading easy.

You will have a clear and simple way to make money with options.

Write down your trading rules and look at them before, during, and after each trade. This will help you stay focused and disciplined.

Making trading rules is the first step to make your option trading easy.

Trading rules will help you stop trading with your feelings and make you trade with your brains.

They will give you a clear and simple way to make money with options.

Step 2: Set Up Alerts

The second step to make your option trading easy is to set up alerts.

Alerts are the things that tell you when to trade and what to do.

They can be based on price, time, or events.

To set up alerts, you need to use a broker’s trading platform, or TradingView, that lets you make and change alerts based on your trading rules.

You can set up alerts for:

Entry: This is the alert that tells you when to start a trade based on your reason. For example, if you trade options based on charts, you can set up an alert that starts when the price of the thing you trade breaks out of a certain range or crosses a certain moving average.

Exit: This is the alert that tells you when to end a trade based on your goal or limit. For example, if you trade options based on a way that goes up or down, you can set up an alert that ends when the price of the option reaches a certain percentage of profit or loss.

Adjustment: This is the alert that tells you when to change a trade based on your way or market conditions. For example, if you trade options based on a way that goes sideways, you can set up an alert that changes when the price of the thing you trade moves beyond a certain range or volatility level.

By setting up alerts, you will be able to make your option trading easy and do your market monitoring for you.

You will get timely and useful alerts that will help you take right actions at the right time.

Try your alerts on a demo account or with small amounts before using them on a real account or with large amounts.

This will help you improve your alerts and avoid mistakes.

Setting up alerts is the second step to make your option trading easy.

Alerts will help you do your trading for you and make your trading better and faster.

Step 3: Use Advanced Orders

The third and last step to make your option trading easy is to use advanced orders.

Advanced orders are the things that let you trade automatically and well.

They can be based on various price levels or percentages.

You can use advanced orders like:

Stop-loss limit: This is an order that lets you end a trade at a certain price or better, but not worse, when the price of the thing you trade reaches a certain level. For example, if you sold a call option at 60 rupees and set a stop-loss limit at 110 rupees with a trigger of 100 rupees, you will end the trade at 110 rupees or lower, but not higher, when the price of the option rises to 100 rupees or above.

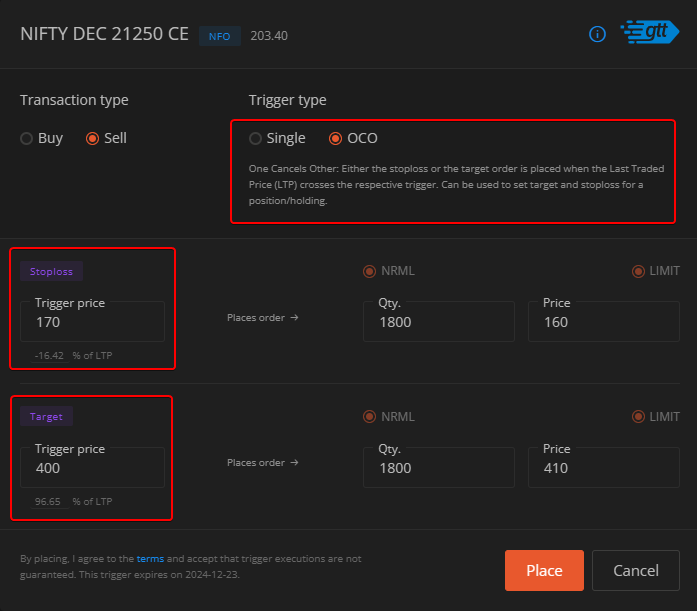

OCO (One Cancels Other) + Good till triggered (GTT): An OCO (One Cancels Other) order is a type of GTT (Good Till Triggered) order that allows you to place two exit orders for a stock or an option, one for a target price and one for a stoploss price. When one of the orders is triggered and executed, the other order is automatically cancelled. The orders stay in the system until triggered or cancelled. For example, if you bought a call option at 200 rupees and set a GTT stop loss order at 170 rupees and profit target at 400 rupees, you will exit the trade when either of these levels are reached, and the orders will stay until done or canceled.

By using advanced orders, you will be able to make your option trading easy and trade automatically and well.

You will trade accurately and reliably at the best price and time.

Use advanced orders with alerts to make a fully systemized trading process without using complicated coding or algorithms.

For example, you can use a price alerting system to start a trade on NIFTY index, and a stop-loss limit order (intraday) OR OCO GTT order to end a trade based on pre-decided price levels.

Using advanced orders is the third and last step to make your option trading easy.

Well done, you have learned how to systemize your option trading in 3 easy steps.

You have learned how to:

Make trading rules that stop you from trading with your feelings and make you trade with your brains.

Set up alerts that do your monitoring for you and make your trading better and faster.

Use advanced orders that trade automatically and well.

Discover the Hidden Hacks of Profitable Options Trading! Join My Upcoming Masterclass! (Limited FREE slots. Click Here to Register NOW)