The One Simple Formula You Need to Measure Your Options Trading Performance Accurately

Calculate Your Real Options Returns With XIRR

Do you know how to measure your options trading performance?

If you're like most traders, you probably look at your account balance or your profit and loss statement to see how much money you made or lost.

But that's not enough.

You see, those numbers don't tell you the whole story. They don't account for the timing and size of your cash flows and the effect of compounding.

That's why you need to use a better metric: XIRR.

XIRR stands for Extended Internal Rate of Return.

It's a formula that calculates your annualized return from options trading, considering all the cash flows and dates related to your trading account. XIRR is the best way to measure your options trading performance.

It shows how much your money grows with compounding over time.

Here's how to calculate it:

Step #1: List cash flows and dates.

You must record all the cash flows related to your options trading account.

This includes deposits, withdrawals, and profits or losses from each trade. You also need to note the dates of each cash flow. For example, let's say you started trading options on January 1, 2024, with an initial deposit of 1,00,000 rupees.

On January 15, you made a profit of 10,000 rupees from a trade.

On January 31, you withdrew 20,000 rupees from your account.

On February 15, you made a loss of 5,000 rupees from a trade.

On February 28, you deposited another 50,000 rupees to your account.

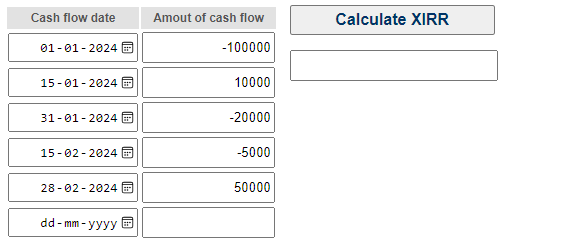

Your cash flows and dates would look like this:

Step #2: Use XIRR calculator or Excel.

You can use an online XIRR calculator or Excel to compute your XIRR.

You just need to enter the cash flows and dates in the appropriate fields. The XIRR function will return a percentage value that represents your annualized return.

For example, using the online XIRR calculator at this link, you would enter the cash flows and dates as shown below:

Alternatively, you can use Excel to calculate your XIRR. You just need to enter the cash flows and dates in two columns and then use the XIRR function in another cell. The syntax of the XIRR function is:

=XIRR(values, dates, [guess])

where:

‘values’ is the range of cash flows,

‘dates’ is the range of dates, and

‘guess’ is an optional argument that specifies an initial estimate of the XIRR (you can leave it blank or enter 0.1).

For example, using Excel, you would enter the cash flows and dates in columns A and B and then use the XIRR function in cell C1 as shown below:

Step #3: Get the XIRR percentage as an annualized return.

The XIRR percentage is your annualized return from options trading.

It tells you how much your money grows each year with compounding. For example, if your XIRR is 50%, it means your money doubles every year.

You can use your XIRR to compare your options trading returns with other investments and benchmarks.

For example, you can compare your XIRR with:

stock market's average return,

a bank account's interest rate,

or a mutual fund's return.

By comparing your XIRR with other returns, you can understand if options trading is worth your time, money, and efforts.

XIRR reveals your compounding power XIRR is a powerful metric that shows your true performance as an options trader.

It accounts for the timing and size of your cash flows and the effect of compounding.

It also allows you to compare your options trading returns with other investments and benchmarks.

By calculating your XIRR, you can understand if options trading is worth your time, money, and effort.

Trade your own profitable options trading system in 90 days! Join My Upcoming Masterclass! (Limited slots. Click Here to Register NOW)