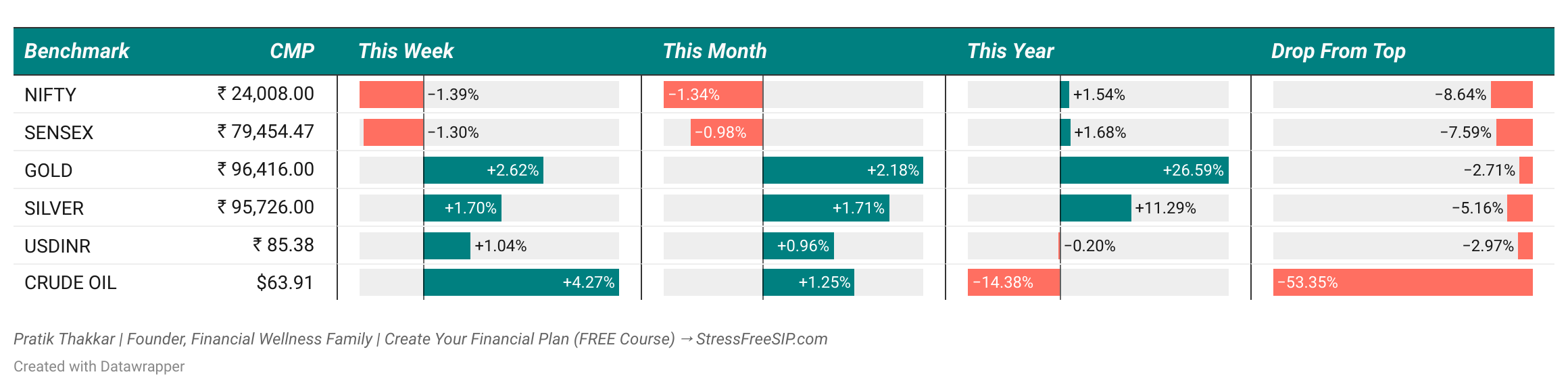

📊Weekly Market Snapshot

Markets played 'geopolitical hot potato' this week as India-Pakistan tensions sent Nifty tumbling 1.39%.

Auto stocks remained in the driver's seat early on, while PSU Banks performed a dramatic zero-to-hero act.

Despite steady FII inflows providing a cushion, border drama stole the show.

💡Weekly Family Financial Wisdom

Choosing Between Direct and Regular Mutual Funds? Here’s What Most People Get Wrong

Most people assume lower costs always mean better returns.

But they forget that making the wrong investment choice - just to save fees - can cost a lot more in the long run.

I've seen it myself. A friend once went all-in on direct mutual funds because he heard “they grow faster.” But he didn’t know how to pick the right funds, ignored rebalancing, and panicked during a market dip. Five years later, he had lower returns than someone who took advice and paid the extra cost. Maybe you’ve done the same, chasing savings without knowing the full picture.

Here’s how to avoid that mistake: Pick regular mutual funds if you need expert help and value peace of mind over small cost savings.

Nearly 60% of investors in India still choose regular mutual funds

That’s right - as of March 2024, nearly 6 in 10 Indian mutual fund investors continued to choose regular plans, valuing advisory support and long-term discipline over cost savings.

Why? Because not everyone has the time, confidence, or know-how to manage investments alone. For first-time investors, the risks of going solo often outweigh the benefits. That little commission you pay to an advisor might be the only thing standing between you and a big financial mistake.

So, here’s the bottom line: If you’re not an expert, it’s smarter (and safer) to pay for guidance than to gamble on your own.

Let’s break down how to make the smart choice:

How To Pick The Right Mutual Fund Plan So You Can Sleep Peacefully

Here’s a quick guide to help you make a smart, stress-free decision.

Know yourself. If you’re new to mutual funds, not confident in picking funds, or don’t track your portfolio regularly, regular plans give you a professional partner.

Understand the trade-off. Yes, direct plans have lower fees—but you’re also flying solo. With regular plans, you’re paying for expert advice, help during market ups and downs, and custom planning.

Match it to your lifestyle. Busy with work and family? Don’t want to worry about market moves? A regular plan lets someone else do the heavy lifting.

Start by talking to a trusted advisor. Share your goals, your income, and how involved you want to be.

When in doubt, go with the plan that saves you from stress, not just from fees.

Now let’s talk about why this matters.

Here's Why You Should Choose a Regular Plan If You're Not a Market Pro

A good advisor is worth more than the fee you pay.

Here’s why that’s true:

Most investors don’t rebalance or review their portfolio regularly.

Emotional decisions during market dips can destroy years of growth.

Advisors bring structure, strategy, and long-term thinking that most DIY investors lack.

For example: One of my clients, a young couple in their early 30s, started with direct funds. They picked random “top-performing” funds without checking risk levels. During a downturn, they sold in panic. Later, they switched to regular funds with me, and we set up a goal-based plan. Three years in, they’ve stayed invested, are closer to their child’s education goal, and feel more confident than ever.

The lesson? You don’t need the “cheapest” plan - you need the right plan. Especially if you’re juggling a busy life and don’t want to worry about fund choices and market timing.

Let your advisor guide the way so you can focus on what matters most - your family, your work, your future.

Advice is an investment, not a cost.

Choosing between direct and regular mutual funds isn’t about which is “better.” It’s about what’s better for you. If you have the time, knowledge, and confidence, go ahead and pick direct plans.

But if you're just starting out, feel unsure, or want expert support - regular plans are the better choice.

You’re not just paying for a service. You’re paying to avoid mistakes, save time, and get guidance that fits your goals.

Choose peace of mind. Choose smart help. Choose what helps you grow without the guesswork.

🛠️ Question of the Week

Oh, and…

Most parents stress about money.

Smart parents use a system.

Discover the Stress-Free SIP System that helps you:

📈 Build long-term wealth

👨👩👧👦 Protect your family’s future

💡 Make money decisions with clarity

🎥 Watch the free training: → Click Here