📊Weekly Market Snapshot

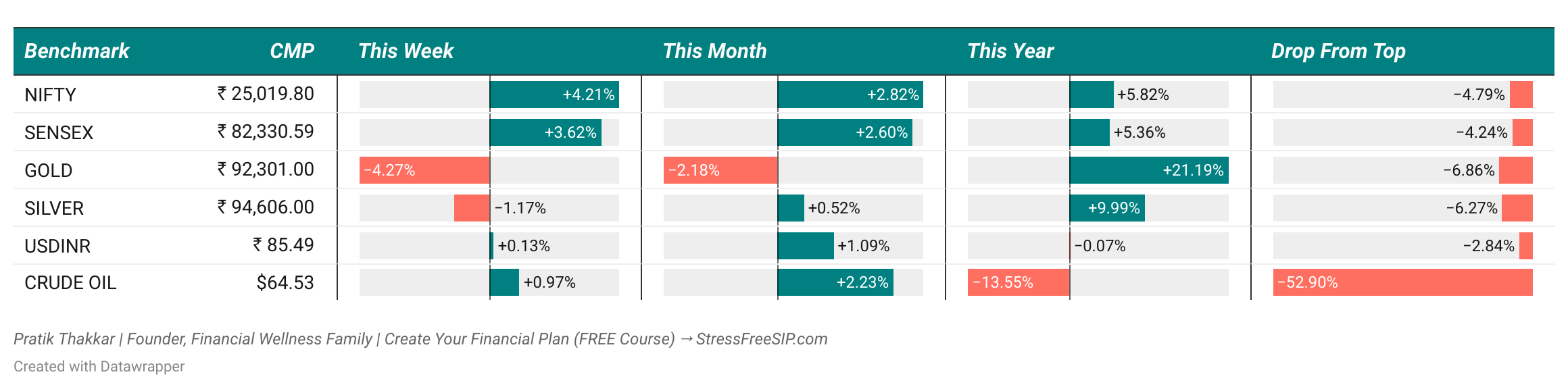

Markets took a bullish stride this week - starting with fireworks from a ceasefire and tariff pause, then wobbling midweek before punching through 25,000 for the first time in months.

FII love, softer inflation, and trade hopes kept spirits high, but geopolitics and earnings still lurk in the wings.

Investors, stay buckled in - this ride isn’t over yet.

💡Weekly Family Financial Wisdom

Stop Losing Money Without Realizing It

It's easier than ever to spend money today - but that also means it’s easier to lose control.

Many people make the mistake of mixing up their spending money and their savings in the same bank account.

When you do that, you don’t know how much you’ve already spent. You might think you have more money than you really do. I used to keep all my money in one place too - and ended up spending way more than I planned. You might be doing the same thing without even realizing it.

Here’s how to avoid that: Separate your money into different accounts for different jobs.

Most People Overspend - and Don’t Even Know It

Studies show that 60% of people don’t track where their money goes each month.

That means they have no idea how much they’re spending or saving. For you, that could mean running out of money before the month ends or not saving enough for things that really matter - like school fees, a family trip, or even retirement.

Here’s the fix: Set up separate bank accounts for spending, saving, and investing.

Let’s talk about how to do that step by step.

How to Manage Your Money So You Feel Safe and In Control

You’ll feel much better about your money once you organize it the right way. Here are three easy steps:

Step 1: Create separate accounts. One for spending (like groceries and bills), one for saving (for future goals), and one for investing (to grow your money).

Step 2: Avoid risky investments. Don’t fall for ads or posts that say, “Double your money fast!” These are usually scams. Stick to safe, proven options like mutual funds and fixed deposits.

Step 3: Stay safe online. Use strong passwords, never click on strange links, and use a VPN when you're on public Wi-Fi.

Start by opening two new bank accounts today - one for saving and one for investing.

Doing this one thing can help you avoid so many money mistakes.

Let’s look at why this really matters.

Here’s Why You Should Organize Your Money Today

Keeping your money organized helps you save more, spend less, and feel in control.

When your money is all in one place, it’s easy to spend too much. When you know exactly where everything goes, it’s easier to reach your goals. And when you protect your money from scams, you stay safe and stress-free.

For example: A friend of mine kept all his salary in one account. Every month, he’d spend a little here, a little there - and never had enough left to save. When he started using different accounts, he finally saved enough to book a family trip to Goa!

The lesson? When you separate your money and protect it, it grows. You don’t feel guilty after spending, and you sleep better at night. If you want to buy a home, plan your kids’ future, or retire comfortably, start organizing your money now.

Remember: “If your money has no plan, it will disappear.”

That’s It!

Smart money habits don’t need to be hard. Just three steps:

Separate your money

Invest wisely

Protect it from fraud

What are you waiting for?

🛠️ Question of the Week

Results of last week:

Last week we asked which goal is most doable for you right now?

Majority folks opted for the first one - this clearly shows that when the goal is specific, measurable, achievable, relevant and time bound, it feels the most doable.

Missed it? you can mark your vote here ▶️ Click here to vote

You made it to the end! Now go claim that well-deserved break.

Your salary shouldn't vanish by the 20th.

You work hard. Your money should too.

This free video training reveals:

✔️ A simple SIP system

✔️ How to save + grow your money

✔️ Peace of mind for your family

🎥 Start watching: → Click Here